Tom Waterhouse of Waterhouse VC explores the mathematical prowess involved in professional betting and discusses why people choose to bet the way they do.

For most of us, it is hard to fathom the mathematical capability possessed by a small number of people. It is even more impressive when these individuals can combine several rare skills together with business acumen to develop a highly profitable enterprise.

We believe that professional betting is one of the most difficult fields in the world. The three keys to winning at betting are: making correct bet selections; betting at an attractive price; correctly staking – knowing how much to wager on each selection.

Successful professional betting requires a combination of incredibly challenging skills:

- Knowing a sport back to front – every player statistic, every last-minute change, every location and playing surface (e.g. clay/grass/hard tennis courts, Emirates Stadium vs Etihad Stadium)

- Complex modelling of the many 100s of various factors that determine a player or team’s likelihood of winning and consequently, their true odds compared to the odds offered by bookmakers (e.g. time since last match, social media activity, injury statistics, travel time to a match, age, weather and why the market has got it wrong)

- Running a betting business (e.g. managing bet placement, bet settlement risk, accessing rebates, intellectual property theft risk, bet theft/leakage of bets risk)

We believe that there are fewer than 50 betting syndicates globally that are able to win more than a million dollars per annum through betting, and a handful that win around a billion dollars.

Waterhouse VC owns a stake in one of these syndicates, which focuses primarily on tennis. The syndicate’s advantage is challenging to duplicate because of the extensive proprietary historical data that it possesses, and the sophisticated factors integrated into its models.

In addition to Waterhouse VC’s stake in Project Tennis, the fund is exploring further opportunities in professional betting. These opportunities are incredibly hard to find and evaluate without specific domain expertise.

Paid to play

One reason that there are so few successful professional racing betting syndicates is that existing large racing syndicates benefit from receiving rebates on their bets. This is regardless of the result, effectively increasing their edge and making it even harder for emerging syndicates to compete.

Racing syndicates receive rebates from pari-mutuel/tote betting in exchange for providing liquidity. To qualify for these rebates, syndicates must wager substantial amounts of money.

For instance, US totes typically extend rebates solely to those who bet over $5 million annually, according to Sports Trading Network. The cumulative effect of their rebate advantage has resulted in substantial profits for the largest syndicates.

Greed is not good

Human behaviour is one of the key contributors to financial cycles as investors swing between fear and greed. Human behaviour allows trading firms to profit from the emotionally driven decisions of retail investors.

Such a dynamic also exists in betting. Here, professional betting syndicates can profit from retail gamblers through exchanges like Betfair and Matchbook. Succumbing to fear and greed rather than solely making analysis-driven decisions is a major pitfall for investors and bettors alike.

Numerous cognitive biases (for example, the ‘illusion of control’) make successful investing and betting incredibly challenging.

Even professional fund managers who possess all necessary technical resources and employ the world’s brightest analysts generally deliver performance below the market to their investors. Over the past decade, 85.6% of active funds have generated lower performance than the S&P500. Underperformance rates exceed 80% across developed markets.

Warren Buffett, often named the world’s best investor, won a million dollar bet that the market would outperform active management.

Greedily flipping coins

Several experiments have looked into how people think about money and make financial decisions.

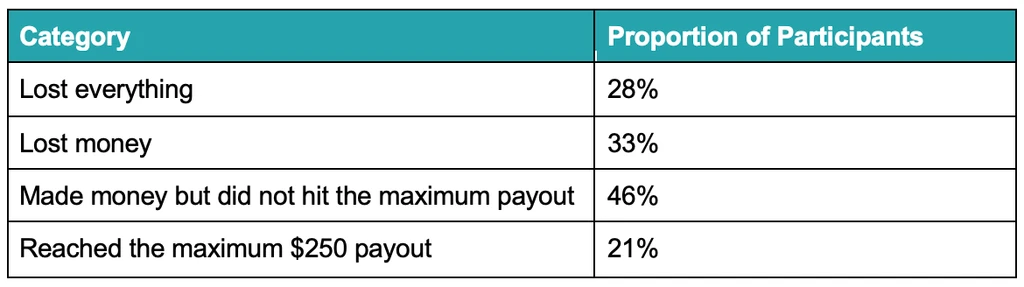

In one experiment from 2013 by Victor Haghani and Richard Dewey, people played a game where they flipped a virtual coin. They were told the coin had a 60% chance of landing on heads. Each person got $25 to start and could bet however they wanted. After 30 minutes of flipping the coin – time for about 300 flips – they received the final payout. This was limited to $250.

Haghani and Dewey calculated that 95% of people were expected to reach the $250 payout limit. But in the end, 33% of people lost money, and only 21% got to $250. In total, 67% of people even tried their luck at least once betting on tails. This was despite being told that tails only had a 40% chance of landing. This is an example of the illusion of control.

Kelly Criterion

The principles guiding success in the coin-flipping experiment can be applied to both professional betting and investing. A simple application of the Kelly Criterion (K%) would have effectively maximised the payout from the coin-flipping activity. The Kelly Criterion aids investors and bettors in optimising portfolio or bankroll diversification. It determines the ideal allocation of funds to each individual investment or bet.

Applying the Kelly Criterion to the above coin-flipping experiment results in betting 20% of your money each time. For example, starting with $25, you’d bet $5 first. If you win, you’d then bet $6 of the $30 you have. If you lose, you’d then bet $4 of the $20 you have left and so on.

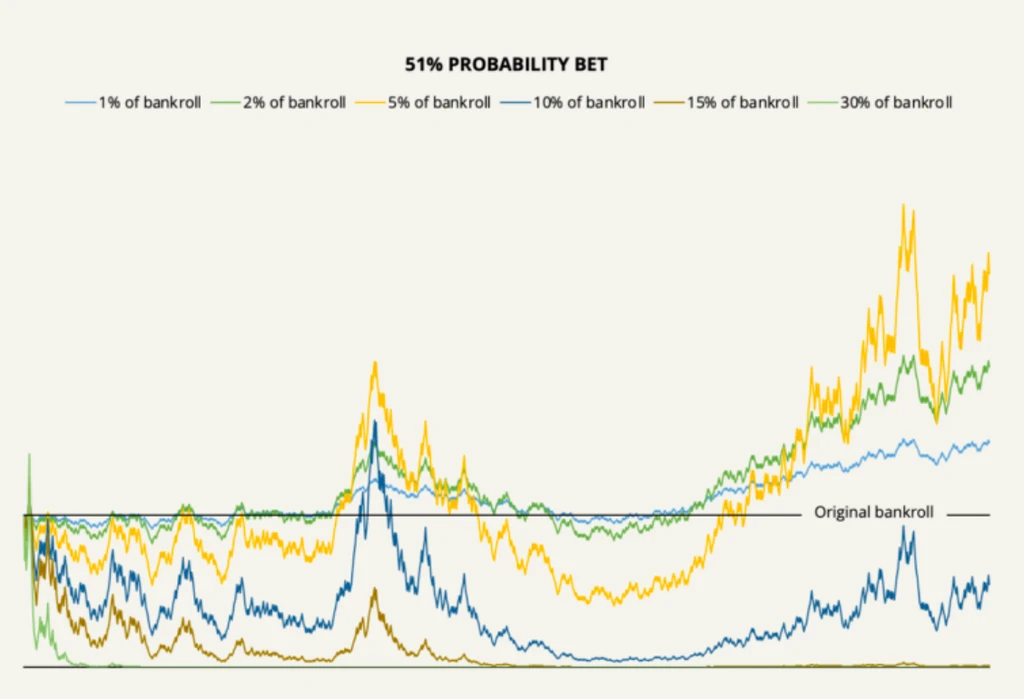

Another example is presented above, with a bet that has a 51% chance of winning. If you bet too cautiously (e.g. 2% of your money each time – refer to the green/second best performing line), you’ll do okay but not great. If you bet too much (e.g. 15% of your money each time – refer to the brown/second worst performing line), you’ll end up losing everything.

This illustrates how crucial position sizing is in both betting and investing. Small changes in how much you bet determine whether you succeed or lose everything.

While it is very difficult operationally and cognitively to win at betting, there are several groups that do so successfully.

Waterhouse VC (a fund for wholesale investors) holds a blend of diversified global listed equities and unlisted investments, leveraging the Waterhouse family’s core areas of expertise. The portfolio is split across three pillars: Option Deals, Global Equities and Professional Betting.

Since its inception in August 2019, Waterhouse VC has achieved a gross total return of 2,744% as at 31 January 2024, assuming the reinvestment of all distributions.