La Française des Jeux (FDJ) has reported a 6.5% year-on-year growth in revenue to €2.62bn (£2.24bn/$2.81bn) for its 2023 financial year.

FDJ attributed the “solid” growth in revenue to momentum in its sports betting and online gaming sectors. This was evidenced by an 18.8% increase in its net gaming revenue (NGR), becoming almost 13% of the group’s NGR.

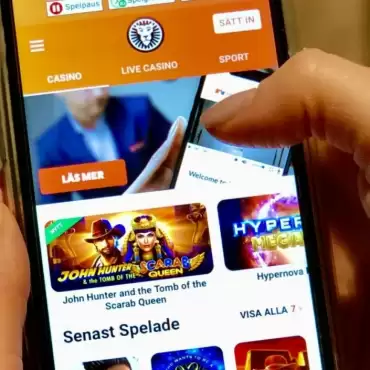

FDJ’s 2023 report came in the wake of the group submitting an offer worth SEK27.96bn (£2.10bn/€2.45bn/$2.67bn) to acquire the entire outstanding share capital of Kindred Group in January.

During 2023, FDJ’s net profit rocketed by 38% to €425m, from 2022’s figure of €307.9m. Recurring operating income shot up from €459m to €532m, again a sizeable rise of 15.8%.

Despite the rise in revenue, the 6.5% revenue hike fell behind the 9.1% increase to $2.46bn reported last year. The previous year’s success was largely powered by an 11% jump in lottery. Interestingly, this was while the lottery sector only grew by 4.9% in 2023.

FDJ recorded an increase in EBITDA of 11.3% to €657m at a margin of 25.1%. The group attributed its net profit hike to the high level of recurring EBITDA and the rise in financial profit.

Dividend growth was also described as “strong”, rising by 30% to €1.78 per share with a payout ratio of 80%. The group says it now has a significant available cash amount of €855m.

FDJ: A commitment to “responsibility”

Stéphane Pallez, chair and CEO of FDJ, said the company had reached milestones in 2023 in regards to its M&A activity.

“FDJ delivered solid growth and results this year,” she said. “The group reached in 2023 a major milestone in the implementation of its strategy with the completion of the acquisition of Premier Lotteries Ireland and ZEturf.

“The proposed acquisition of Kindred, announced at the end of January, will enable the creation of a European champion and significant value creation for the benefit of all stakeholders, in line with our model combining performance and responsibility.”

A large feature in FDJ’s 2023 financial year report was the theme of responsible growth. The group emphasised a three-pronged plan to help with that strategy.

The first is an extensive model on recreational gaming. FDJ revealed that less than 2% of its online lottery gross gaming revenue comes from high-risk players. Meanwhile, over 10% of the group’s advertising budget is also allocated to responsible gambling.

The company also plans to recognise its societal commitments. This means particular attention is attributed to maintaining the highest level of extra-financial ratings. Notably, this includes a 72/100 score from Moody’s ESG Solutions for financial sustainability.

FDJ is also keen for its performance to benefit all stakeholders. The company has contributed €4.3bn to public finances as well as created 56,000 jobs. Some 21,800 of these are in local retail trade.

FDJ’s proposed acquisition of Kindred

In a statement following the bid, FDJ stated the deal to acquire Kindred would create the second largest operator in Europe’s gaming sector. It added the combination would result in a “European gaming champion” with stronger revenue and earnings growth.

Both the Kindred and FDJ boards are supporting the proposed acquisition. This would be the latest in a string of purchases for the French lottery and gaming giant.

FDJ completed a €175m acquisition of ZEturf in October, while the group also finalised the purchase of Premier Lotteries Ireland the following month in a deal worth €350m. In the 2023 report, FDJ stated the integration of those two companies had been “in line with expectations”.

Looking ahead to 2024

In terms of 2024, FDJ is targeting an 8% revenue growth across the group with a recurring EBITDA margin of approximately 24.5%.

The group is looking for 5% revenue growth in terms of its lottery and sports betting and online gaming open to competition sectors over the next financial year. This will be powered by the large number of sporting events in 2024, including the Paris Olympics and the UEFA European Championships.

FDJ is also expecting additional growth to come from the contribution of other activities such as international, payment and services.

The deal with Kindred opens up FDJ to future growth, too. In an interview with iGB, Ed Birkin, a senior analyst at H2 Gambling Capital, called the move a “meaningful step-change” in FDJ strategy towards becoming a “multi-product top-tier European operator”.