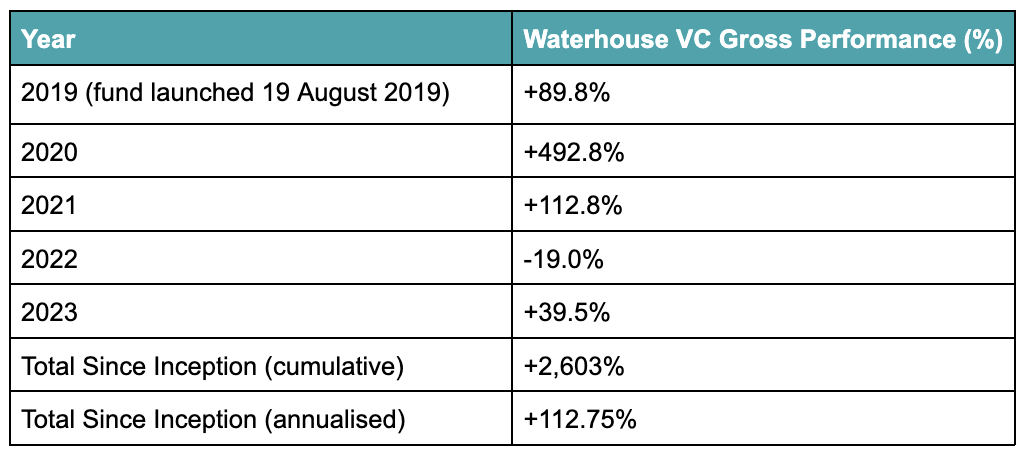

In his first column of the year, Tom Waterhouse of Waterhouse VC looks back at the ups and downs of 2023 – and discusses what lies ahead in 2024.

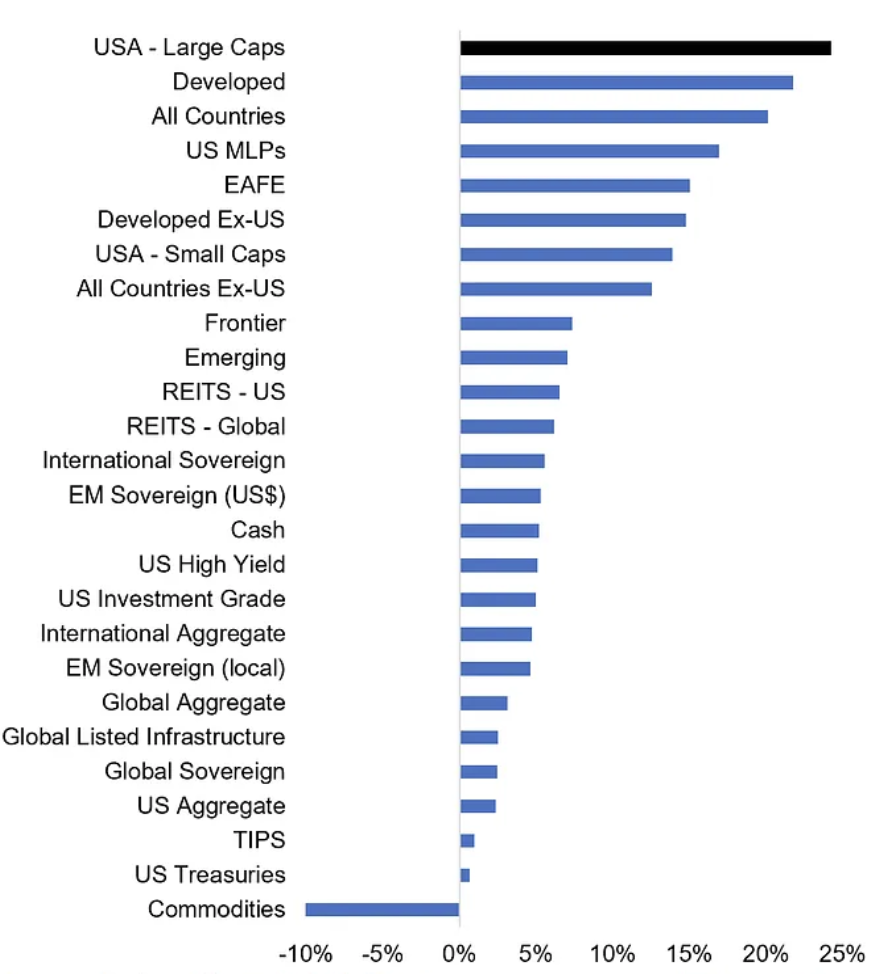

While company valuations broadly increased in 2023, there was significant divergence across geographies and sectors. With the increase in interest rates globally, investors have grown more selective, preferring to invest in profitable businesses.

In 2023, there were two stand out contributors to the fund’s +39.5% performance:

- Project Tennis – a professional betting syndicate founded by Tom Dry focused on tennis. It was first discussed in December 2022 and invested in on 1 July 2023.

- Saintly – a crypto wagering operator and B2B platform. Position exited in August 2023.

Beating the house

We are very pleased with the operational performance of Tom Dry’s betting syndicate going into 2024. The fund is on track to earn back in distributions its entire investment in the syndicate by January 2025. This will be just 18 months after the investment was made. More broadly, professional betting is a key focus area for the fund. We are actively exploring several professional betting opportunities.

In addition to tennis, we are looking at other professional betting opportunities in horse racing. Horse racing is particularly interesting due to the rebates offered by totes. Large syndicates benefit from generous rebates in pari-mutuel/tote betting, thanks to their role in supplying liquidity. This gives them a significant advantage – which varies based on the tote pool – over other bettors.

To qualify for these rebates, syndicates must wager substantial amounts of money. For example, US totes typically only grant rebates to those who wager over $5m per year, according to the Sports Trading Network.

Emerging professional betting syndicates focused on racing are already behind the larger syndicates by a few percentage points because of the rebates that the larger syndicates receive. The accumulation of the rebate advantage has resulted in substantial and lucrative profits for the largest racing-focused syndicates.

If Waterhouse VC could own a stake in a syndicate that bets on racing and receives rebates from the totes, that would be a very exciting portfolio holding.

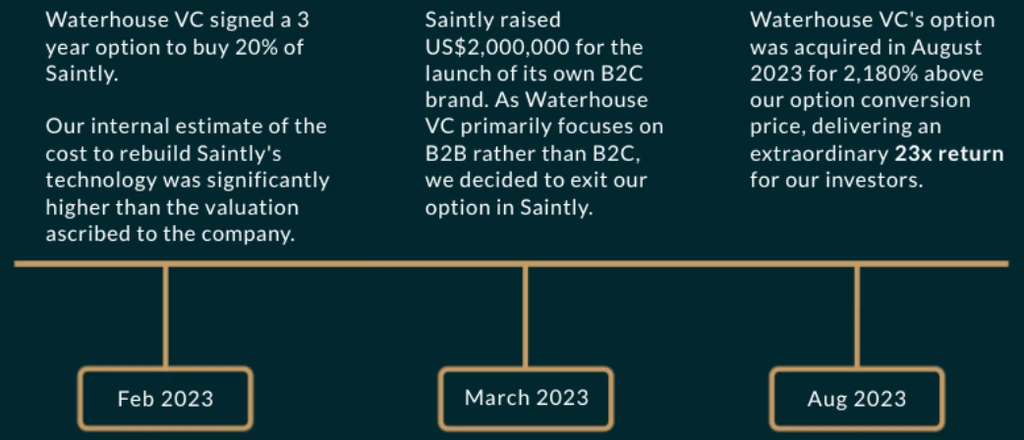

Saintly – a seven month journey

Saintly was the largest single contributor to the fund’s performance in 2023. We negotiated an option to buy 20% of Saintly in February 2023 because of its technology platform, which positioned the company well to take advantage of the burgeoning opportunity in crypto wagering, which we first discussed in May 2022.

Online crypto operators – such as Sportsbet.io and Stake.com – which have a similar UX to online fiat operators like FanDuel and DraftKings are already recording extraordinary turnover.

The timeline below shows the history of Waterhouse VC’s option deal with Saintly from signing in February 2023 through to exiting in August 2023 for 23 times the option conversion valuation.

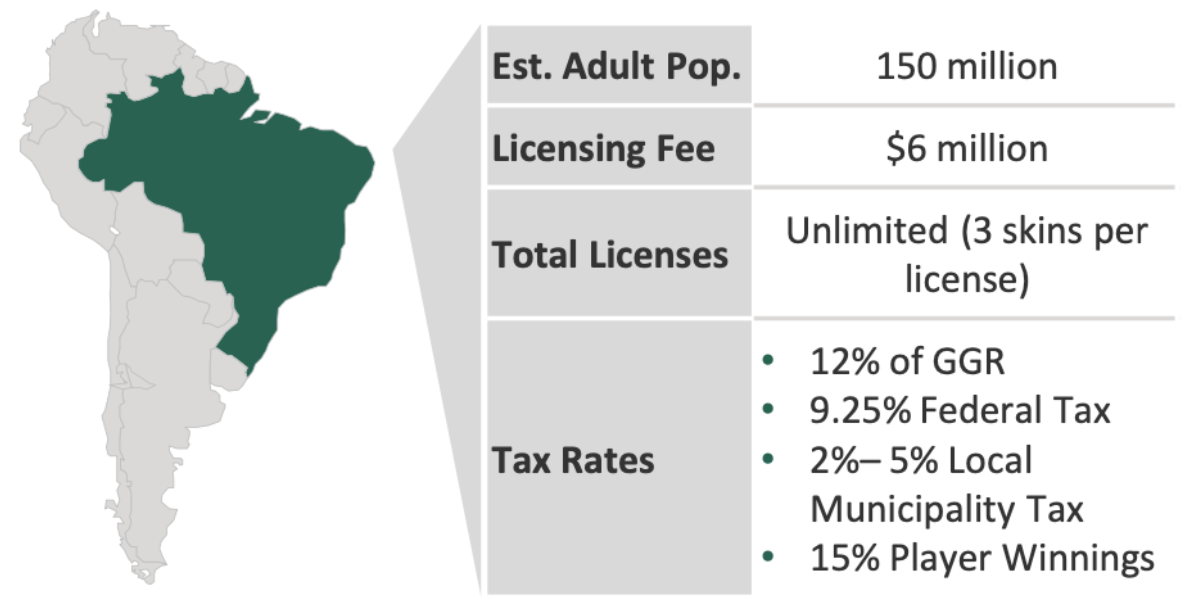

India and Brazil – emerging market opportunities

As we look forward to 2024, emerging markets such as Brazil and India will be key growth regions for both operators and B2B suppliers.

The online wagering industry in India is growing at over 20% per annum (Sportskeeda). It has been fuelled by the country’s rapid economic progress, with GDP per capita up 2x since 2009, and a substantial market size of over 370 million bettors (MyBetting India).

Wagering turnover on cricket alone is estimated to be $150bn, with approximately 85% of Indian bettors engaging in cricket wagers (GiiResearch). The legal status of wagering in India remains grey in most areas.

Brazil recently introduced online wagering following official approval from the country’s president Lula da Silva. Operators are anticipating the imminent launch of the newly regulated industry, with 134 operators having already signed pre-market ordinance measures.

Looking to 2024

We are particularly excited by professional betting, emerging markets such as Brazil and India and B2B suppliers that provide a critical or truly unique service to gaming and wagering operators.

Waterhouse VC has identified several companies in the industry currently valued attractively at just 1x revenue plus approximately their net cash on the balance sheet. We offer wholesale investors unique access to these larger deals, which remain at depressed valuations.

Waterhouse VC is a fund for wholesale investors, specialising in global publicly listed and private businesses related to wagering and gaming.

In 2023, Waterhouse VC generated a strong return of +39.5%, strongly outperforming the S&P500 (+24.8%) and the ASX200 (+7.8%).

For wholesale investors interested in following wagering and gaming industry news and trends, please follow Waterhouse VC updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.